TD Bank Loyalty

Uncovering key drivers of loyalty to inform future-facing design decisions.

Overview

My Role

My Tasks

In January 2025, I joined TD Bank as a UX Design Intern within the Human-Centered Design Practice team, where I contributed to strategic design efforts on the Loyalty team. My role focused on understanding and enhancing loyalty across various customer and internal journeys through research synthesis, stakeholder engagement, and competitive analysis.

Support TD Bank in defining what Loyalty means and uncover key emotional, experiential, and strategic drivers that can shape a future enterprise loyalty programs

Research and identify Year-In-Review strategy

Planned, facilitated and designed a hybrid ideation workshop

Conducted secondary research and competitive analysis on the theme of loyalty

Synthesized findings into a current-state loyalty landscape

Challenge

Loyalty in financial services is complex and multifaceted, shaped by emotional, transactional, and experiential factors. Our team was tasked with exploring how TD could strengthen customer loyalty by identifying current gaps and opportunities, gathering internal perspectives, and examining industry best practices.

A week after I joined the team, I was assigned to design and facilitate the virtual component of a hybrid Loyalty Ideation Workshop and later helped lead the synthesis of both stakeholder input and research data into actionable insights.

My Tasks throughout my Internship:

Designed virtual collaboration materials

Facilitated the virtual aspect of the hybrid workshop on Teams

Conducted research synthesis and analysis

Participated in internal interviews as a note taker and transcriber

Contributed to insight synthesis and storytelling

Loyalty Workshop

1. Workshop Design & Facilitation

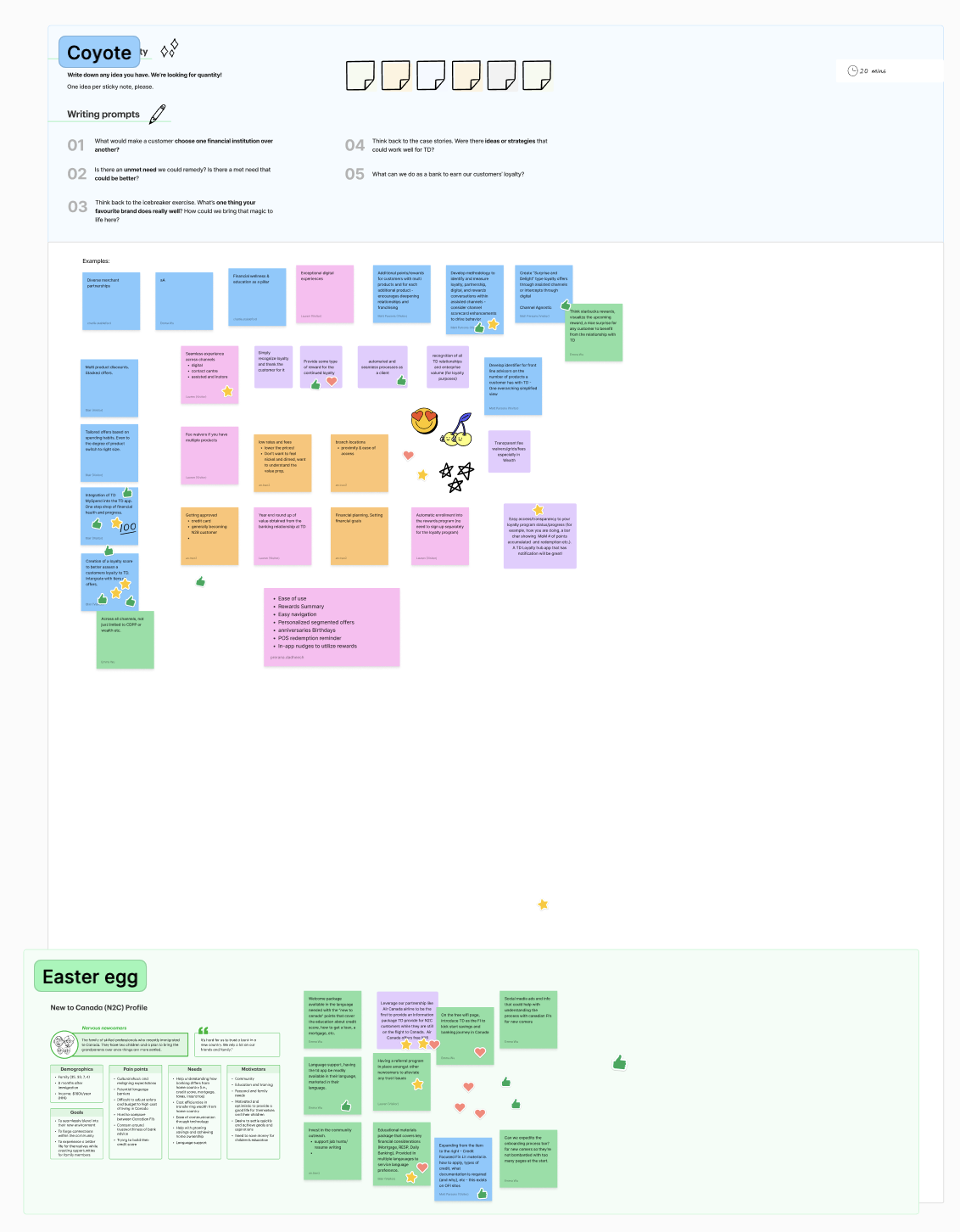

Right from the start, I was responsible for designing the virtual engagement portion of our hybrid Loyalty Workshop. This involved preparing Figma boards and guiding stakeholders through activities that explored:

Definitions of loyalty across journeys

Key emotional and experiential drivers of loyalty

Opportunities for quick wins and long-term strategies

I facilitated the virtual flow of the session, ensuring smooth collaboration among in-person and remote participants.

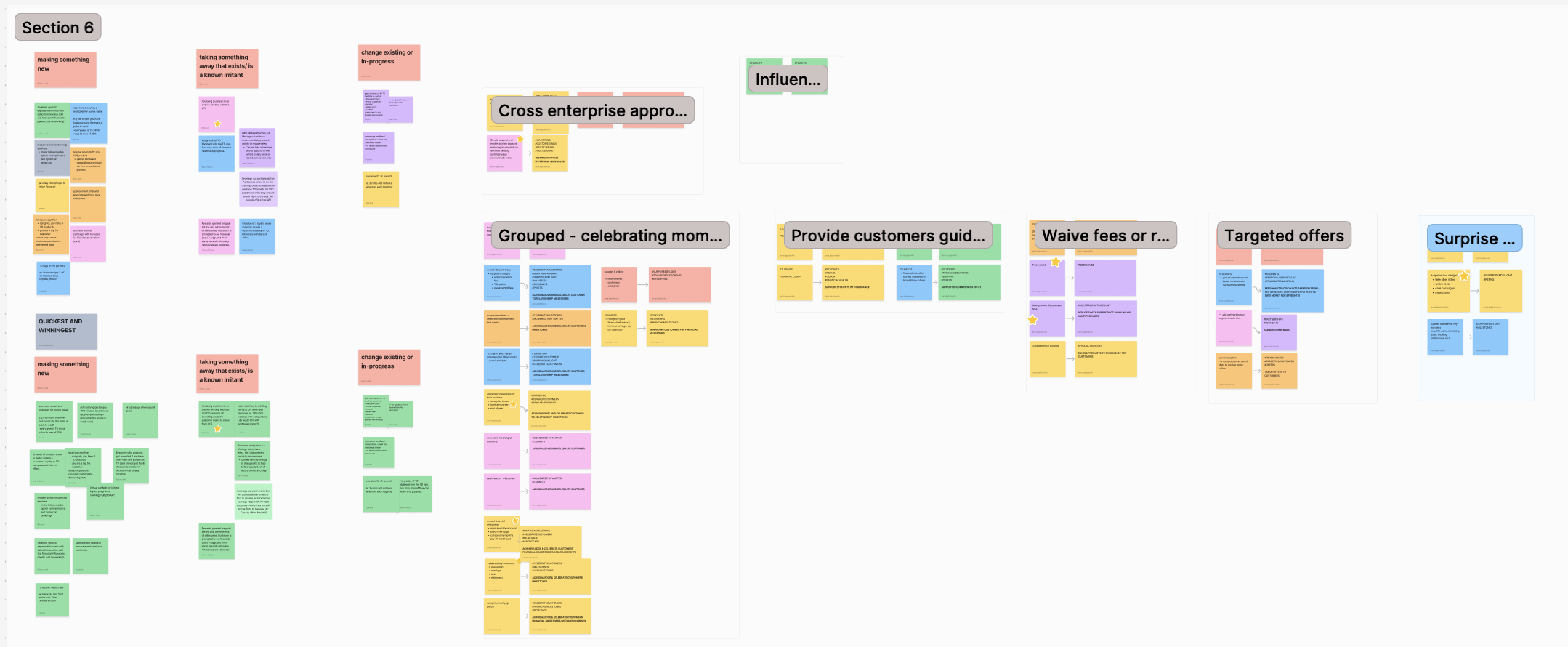

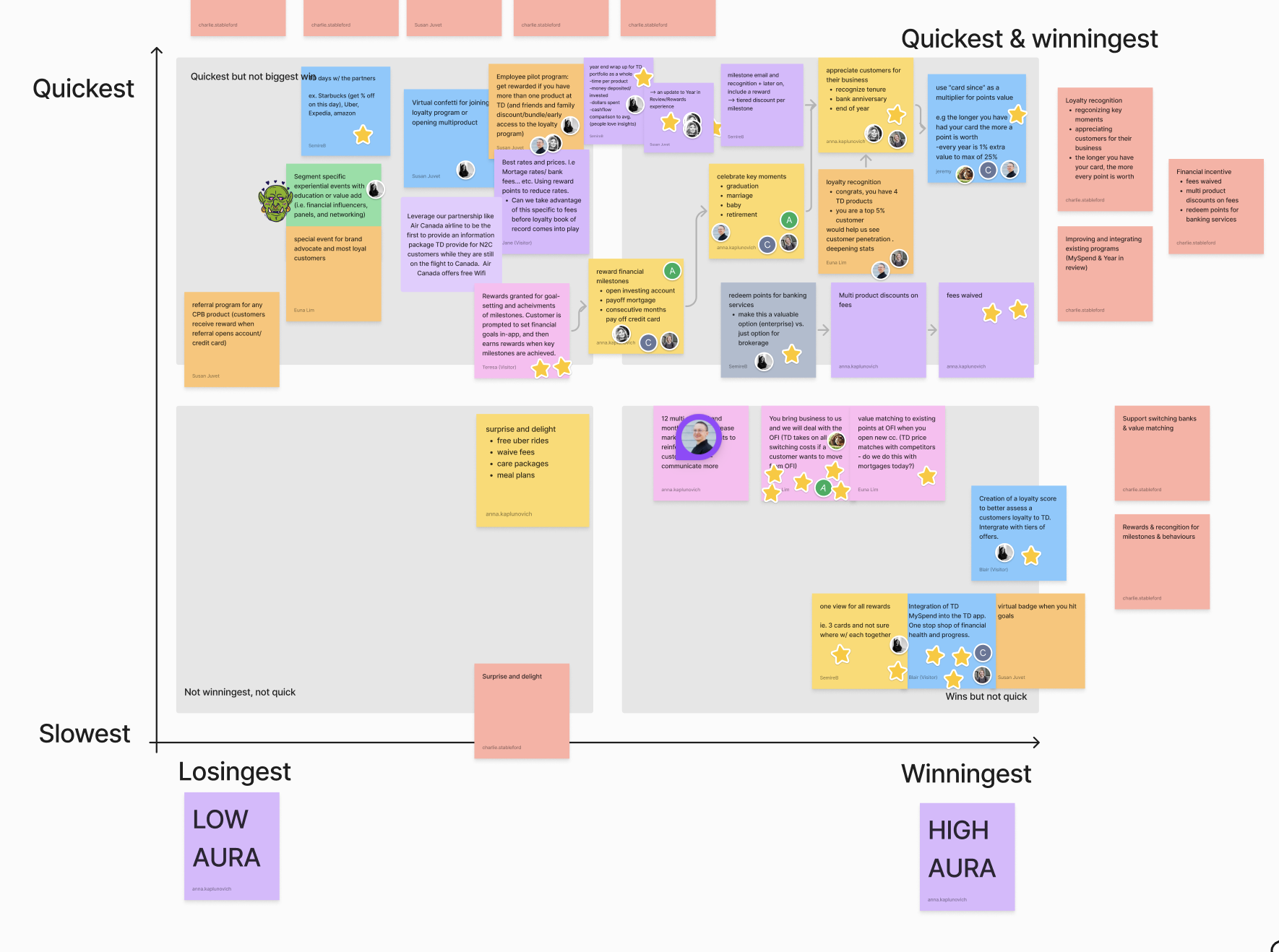

2. Synthesis of Workshop Insights

After the workshop, I gathered all the stakeholder input and began synthesizing the data. I:

Categorized responses by themes (e.g., trust, personalization, reward experiences)

Identified recurring patterns across different stakeholder groups

Mapped potential ideas on a matrix based on impact and feasibility (quick wins vs. long-term efforts)

Co-created a final presentation deck summarizing our insights and opportunity areas, which we delivered to stakeholders

Secondary Research

Interviews

3. Secondary Research & Competitive Analysis

Following the workshop, we dove into existing loyalty-related research conducted internally. I reviewed white papers, internal reports, and persona documents to understand:

TD’s existing approaches to loyalty

Gaps in current experience offerings

Past loyalty initiatives and user sentiment

I conducted a competitive analysis of both financial and non-financial institutions (e.g., fintech apps, retail loyalty programs) to uncover:

How competitors define and foster loyalty

Common loyalty-enhancing features (e.g., gamification, tailored rewards)

Emerging trends in user engagement

4. Internal Interviews

To further enrich our understanding, our team conducted interviews with TD employees across various journeys. I acted as the note taker and transcriber, and later synthesized the interviews to extract recurring themes, such as:

The importance of personalization

Customers being recognized for their loyalty and tenureship

Getting rewarded for their loyalty based on their preferences

Receiving advices from the same advisor and not a different one every time

Key Takeaways

Customers from different segments all have different needs, wants and goals (E.g. HNW, N2C, Gen Z, Millennials, Baby boomers, etc.)

Personalized Rewards: Tailoring rewards to customer lifestyles drives engagement and emotional connection.

Ease of Access: Having one product across all platforms instead of having multiple products. Seamless navigation and digital experiences build long-term retention.

Recognition: Users value acknowledgment for their longevity and loyalty with the brand.

Trust and Transparency: Users stay loyal to brands that communicate clearly and deliver consistently.

Year-In-Review

Our Approach

Discourse Analysis

In addition to loyalty, I was also tasked with exploring opportunities around Year-in-Review (YIR) experiences—an emerging trend in digital engagement used by brands to build connection, reflection, and retention.

The goal was to understand how TD might leverage a Year-in-Review feature to engage customers at the end of each year.

Conduct extensive secondary research on how both financial and non-financial institutions (e.g., Spotify, Apple, fintechs, airlines, and banks) design and deliver their YIR experiences.

I found that the success and structure of a Year-in-Review experience depends heavily on what the organization wants to achieve and—more importantly—what the user values most in that reflection moment.

I did a mini discourse analysis from comments I gathered off of Reddit to identify what users really want for “Year-In-Reviews”.

Are users looking for a celebratory moment that highlights their achievements in a fun and visual way?

Do they want educational insights to help reflect on their financial behaviors and make better decisions moving forward?

Or are they hoping for a blend of both—a reflective moment that’s emotionally engaging and informative?

Reflection

This internship allowed me to work cross-functionally with UX researchers, strategists, and product managers, while contributing to meaningful initiatives around customer experience and engagement. I developed a deeper understanding of how to:

Translate qualitative insights into design opportunities

Facilitate collaboration across hybrid environments

Apply human-centered design principles to a large-scale enterprise context

I’m proud to have supported the Loyalty team’s journey and to contribute to solutions that enhance how customers connect with TD Bank.